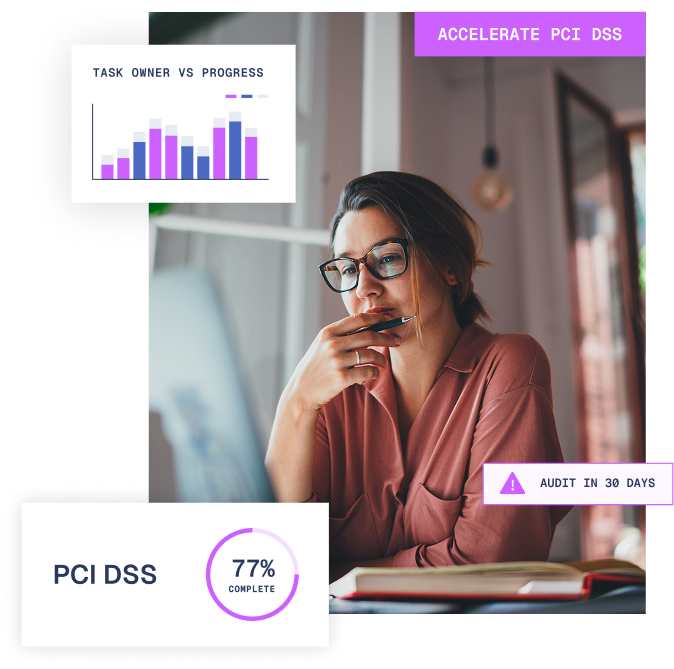

Accelerate and simplify PCI DSS compliance

- Automate PCI DSS certification and achieve continuous compliance

- Help and guide teams at every turn while returning up to 50% of their time

- Get complete visibility across your entire PCI DSS program

- Get access to an experienced CISO level expert as standard

What you can expect from Vambrace

A full, fast, and automated PCI DSS compliance service that starts with mapping your validation requirements before conducting automated gap analysis against PCI DSS v4.0.1 to pinpoint where your organisation is falling short.

Speak to a PCI DSS expert

Ready to get a faster, clearer, and simpler view of PCI DSS compliance?

Whether you need help with a project, or just some quick advice, our team of experienced PCI DSS experts are here for you. Simply complete the form, or give us a call on 0330 460 4633 to start a conversation.

Trusted to provide a faster, clearer, and simpler view of cybersecurity by

Accelerate PCI DSS compliance

With Aegis, the AI driven, automation powered platform that takes on the heavy lifting associated with PCI DSS.

Automated evidence gathering, pre-populated documentation, and continuous monitoring will reduce discovery and setup time by up to 50% when compared to outdated manual processes.

- Aegis automatically cross-references existing evidence and controls already in place for other standards that can be used for PCI DSS.

- Make the move from periodical checkbox to continuous compliance, where controls are monitored, measured, and maintained year-round so your team are ahead of the game, ready for a swift, cost-effective, re-certification that has zero impact on operations.

- Instead of drafting multiple documents from scratch, Aegis automatically generates custom policy templates and security procedures mapped to PCI DSS.

- Demonstrate and easily share your compliance achievements in the Aegis Evidence Hub for your auditors, clients, regulators, and prospects to view.

The role of your vCISO

All Aegis clients are assigned their own Virtual CISO (vCISO) as standard.

This experienced cybersecurity and compliance leader will be the main point of contact throughout our relationship and will lead the PCI DSS certification process.

A vCISO takes the risk out of a high-cost hire. Full time CISOs are expensive but the truth is while all organisations need cybersecurity leadership to oversee security strategy and compliance, most do not need to pay for it on a full-time basis.

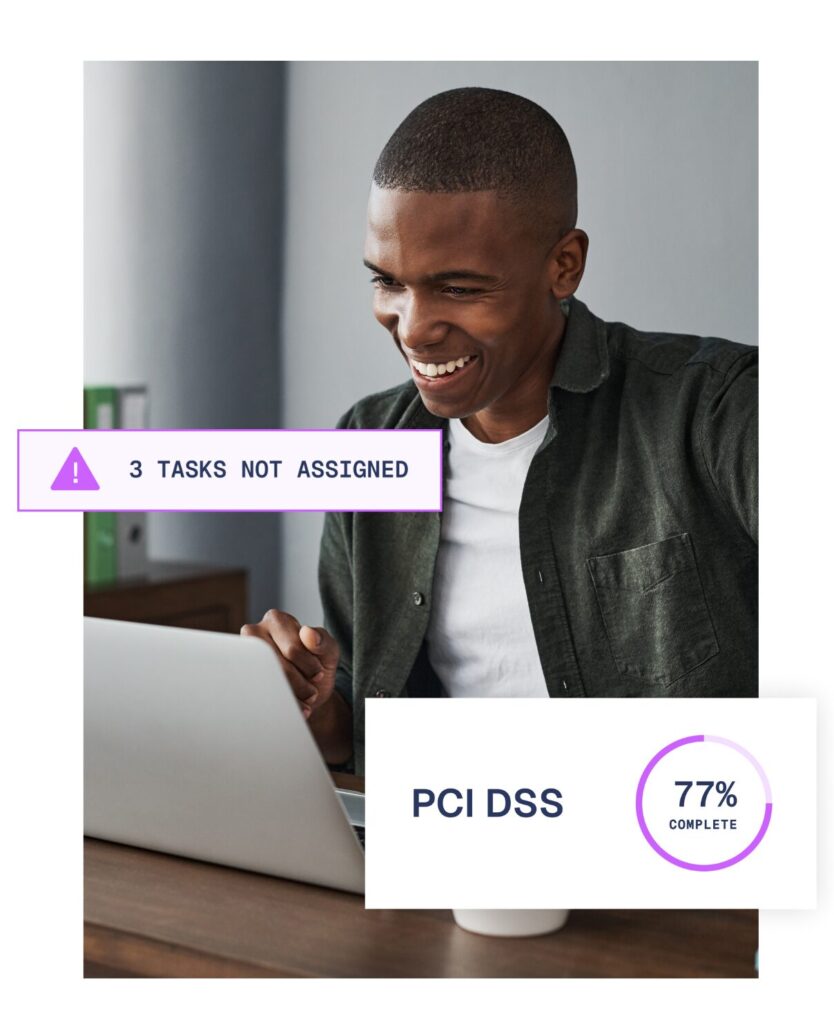

Automate and streamline PCI DSS compliance at scale

Get immediate alerts to new and evolving gaps and inconsistencies that could impact PCI DSS compliance thanks to Aegis’ powerful AI driven automation and continuous monitoring.

- Generate PCI-specific gap assessments to quickly pinpoint control failures.

- Automate policy generation for controls including access and encryption.

- Execute real-time compliance tracking.

- Prepare audit-ready documentation, automatically collected and organised.

- Share and create scalable workflows and assign tasks to team members.

Be PCI DSS compliant every day, not just on audit day.

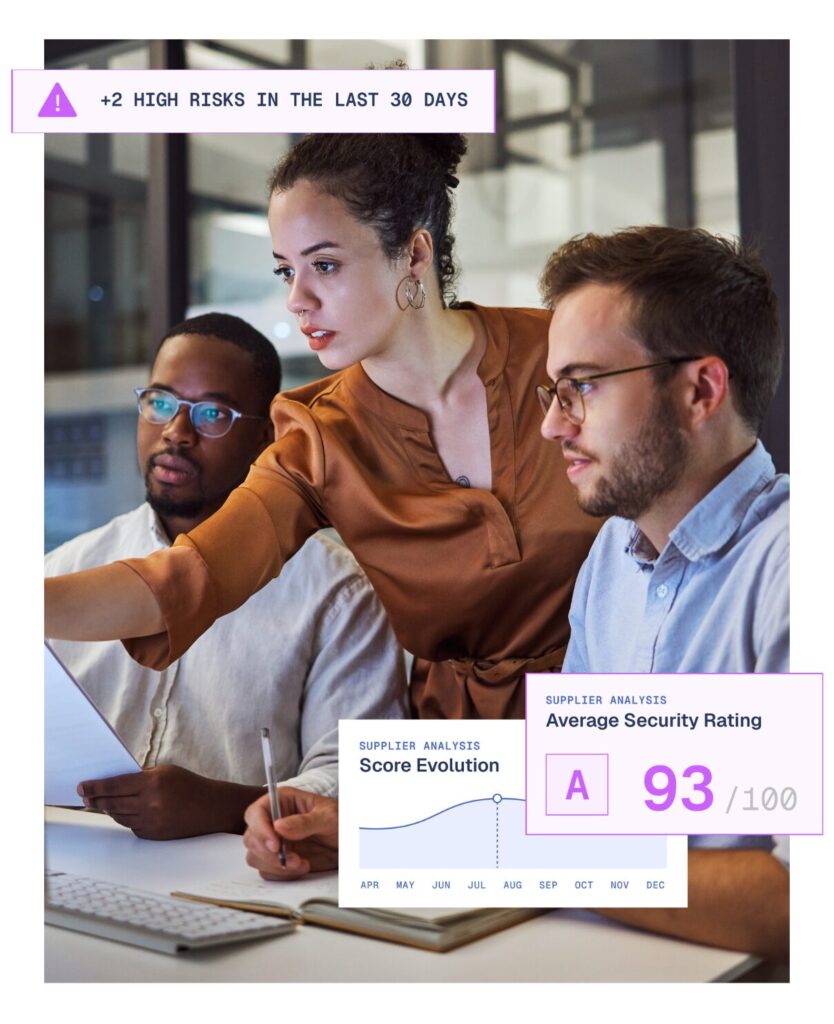

Achieving ongoing PCI DSS compliance is about maintaining the controls and processes around firewalls, encryption, secure authentication, and regular vulnerability scanning.

To succeed, automation and real-time visibility is essential. The last thing leaders need is for new issues to surface close to a re-certification date, resulting in costly delays. Aegis is continuously monitors your systems, immediately flagging issues, and generating remediation snippets so teams can resolve failing areas fast.

Reasons to accelerate PCI DSS compliance

Strengthen your data security

At its core, PCI DSS is all about improving the way organisations store, process, and transmit sensitive payment and customer data. By implementing its security controls around firewalls, encryption, secure authentication, and regular vulnerability scanning you reduce the chances of being impacted by a cyber-attack or data breach.

PCI DSS supports your wider risk management strategy, aligning with other compliance frameworks such as NIST and GDPR.

Build customer trust

Customers are more cautious than ever when it comes to sharing their personal and financial information. Knowing your business complies with PCI DSS, will help them feel more confident that their card and personal data are being handled responsibly.

A top tip from Vambrace is to shout about your compliance achievements like PCI DSS with a logo onto your website to reassure customers. You will be amazed how many of your competitors do not do this!

Improve operational efficiencies

As you work to secure your payment environment, you may also find opportunities to streamline processes, update outdated software, and train employees more effectively.

Improved processes not only enhance security, but also lead to more efficient operations, reduced downtime, and fewer human errors all of which benefit your bottom line.

PCI DSS FAQs

PCI DSS stands for Payment Card Industry Data Security Standard. It is a set of security requirements designed to ensure that all companies that process, store, or transmit credit card and other customer information maintain a secure environment.

Any organisation, regardless of size or number of transactions that handles credit card payments must comply with PCI DSS. This includes e-commerce websites, retail stores, and service providers. The number of transactions you process will determine your PCI DSS obligations. For example, a Level 4 organisation (who process fewer than 20,000 e-commerce transactions per year) may only need to complete a Self-Assessment Questionnaire (SAQ) and conduct a quarterly vulnerability scan. For major retailers processing millions of transactions the list of requirements will be substantially longer and require a full external audit by a PCI DSS Assessor.

While there is no direct legal requirement for compliance with PCI DSS in the UK, and it is not enforced by a government agency, in reality it is almost impossible to operate without it. Compliance is contractually enforced by major credit card brands and banks. Non-compliant organisations can find themselves issued with fines by their card provider, while it is a banks responsibility to monitor the day-to-day PCI DSS compliance of businesses. Failure to comply can result in the bank removing the ability of a merchant to take payments until they do. Non-compliant companies are also at risk civil legal action in the event of a data breach.

There are three ways a PCI DSS audit can be carried out :

- By a Qualified Security Assessor (QSA). A QSA is a security professional certified by the PCI Security Standards Council (PCI SSC). They are authorised to perform onsite audits, assess compliance, and produce a Report on Compliance (ROC).

- By an Internal Security Assessor (ISA). An ISA is an employee who has been trained and certified by the PCI SSC. ISAs can conduct internal PCI DSS assessments for their company, but not for third parties.

- Self-assessment Questionnaire (SAQ). For small to mid-sized businesses that process a lower volume of credit card transactions PCI DSS compliance via an SAQ is an option. However, this does require some understanding of your PCI compliance scope, so taking the advice from a QSA is advised.

Yes. PCI DSS compliance applies for any entity that stores, processes, or transmits cardholder data, regardless of whether these activities are conducted directly or by a third-party service provider. If a merchant outsources its payment processing to a third party and does not store, process, or transmit cardholder data, many PCI DSS requirements may not apply directly to the merchant. However, this does not remove their responsibility to ensure data is properly protected by the third party.

Validation is typically required annually, but frequency may vary based on your merchant level and volume of card transactions you process. There may also be a need to perform a quarterly network vulnerability scan.