Are you getting maximum value from your cyber insurance?

- We put structures in place to ensure your provider can respond quickly and simplify the claims process

- Ensure your investment in cybersecurity is being recognised by your insurer

- Reduce premiums by evidencing your mature cybersecurity capabilities

- Navigate the process with an experienced Vambrace CISO level consultant

It’s important to get cybersecurity insurance right

In the face of increasingly capable threat actors and the frequency of cyber-attacks against UK organisations, you need to be 100% sure your cyber insurance policy is fit for purpose. A cyber insurance assessment will do this for you.

By combining evidence and data from Vambrace’s automated risk, compliance, and security operations, our experienced vCISO’s work closely with a network of partners to engage with brokers or current cyber insurers regarding commercial terms and your level of cover to reduce risk exposure.

Speak to an expert

Make sure your cyber insurance is right and working for you

Our CISO level consultants are highly experienced in evaluating existing cyber postures and where the biggest wins can be made in terms of reducing premiums and improving cover. Complete the form to start a conversation or give us a call on 0330 460 4633

Trusted to provide a faster, clearer, and simpler view of cybersecurity by

How a Vambrace cyber insurance assessment works

Some organisations simply do not possess an individual with the skills to thoroughly evaluate a cybersecurity insurance policy.

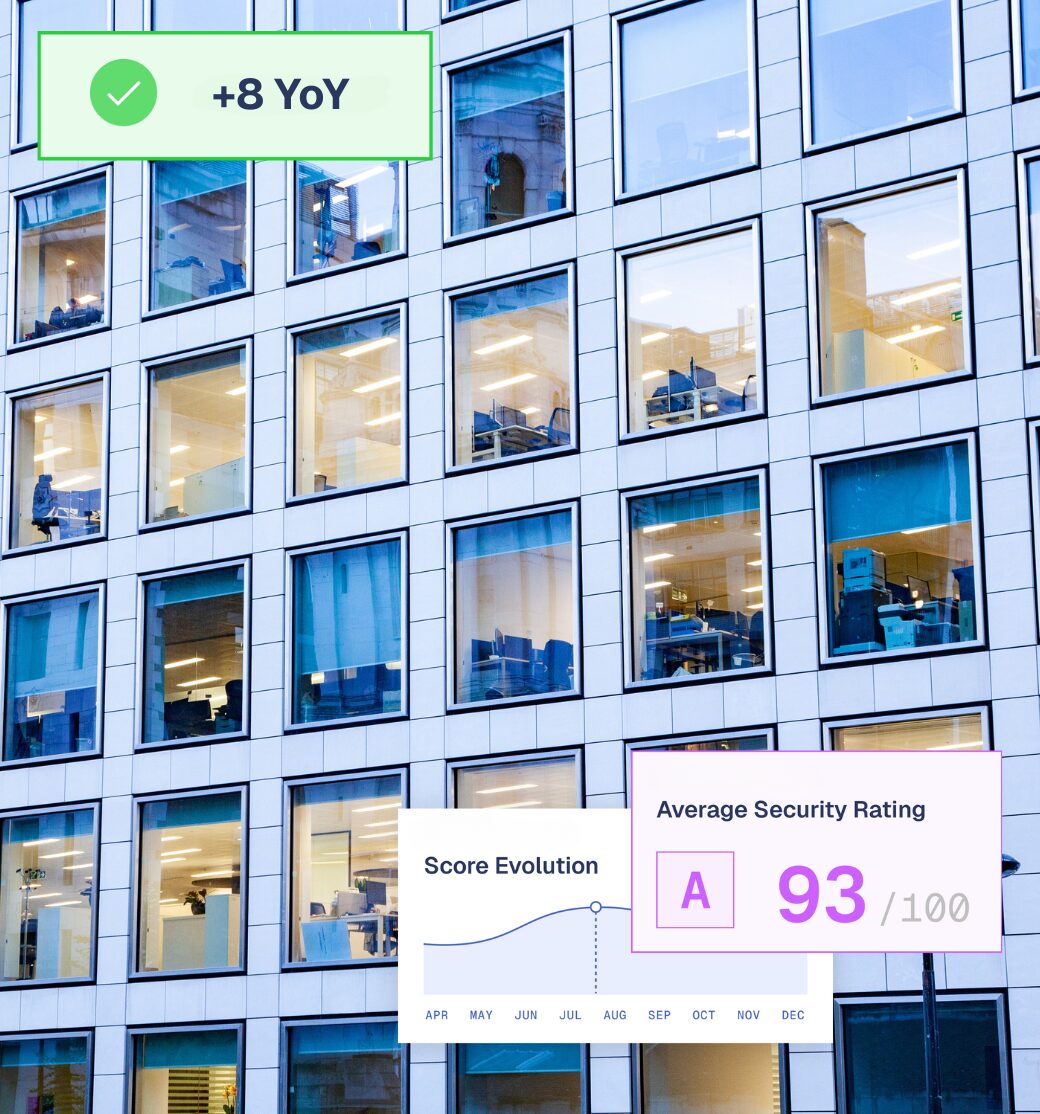

Our vCISO’s are highly experienced with the security controls cyber insurers prioritise, and closing the compliance gaps that are key to reducing your risk profile, increasing the likelihood of insurability, while potentially lowering your premiums. You will be assigned you own vCISO at the start of your cyber insurance assessment.

You make the decision to take out or re-new a cyber insurance policy

A wise move. On your behalf, your vCISO will initiate conversations with a network of highly trusted brokers who are experienced in standalone cyber insurance policies. They will also work with your team to understand key cybersecurity controls currently in place that impact insurance terms.

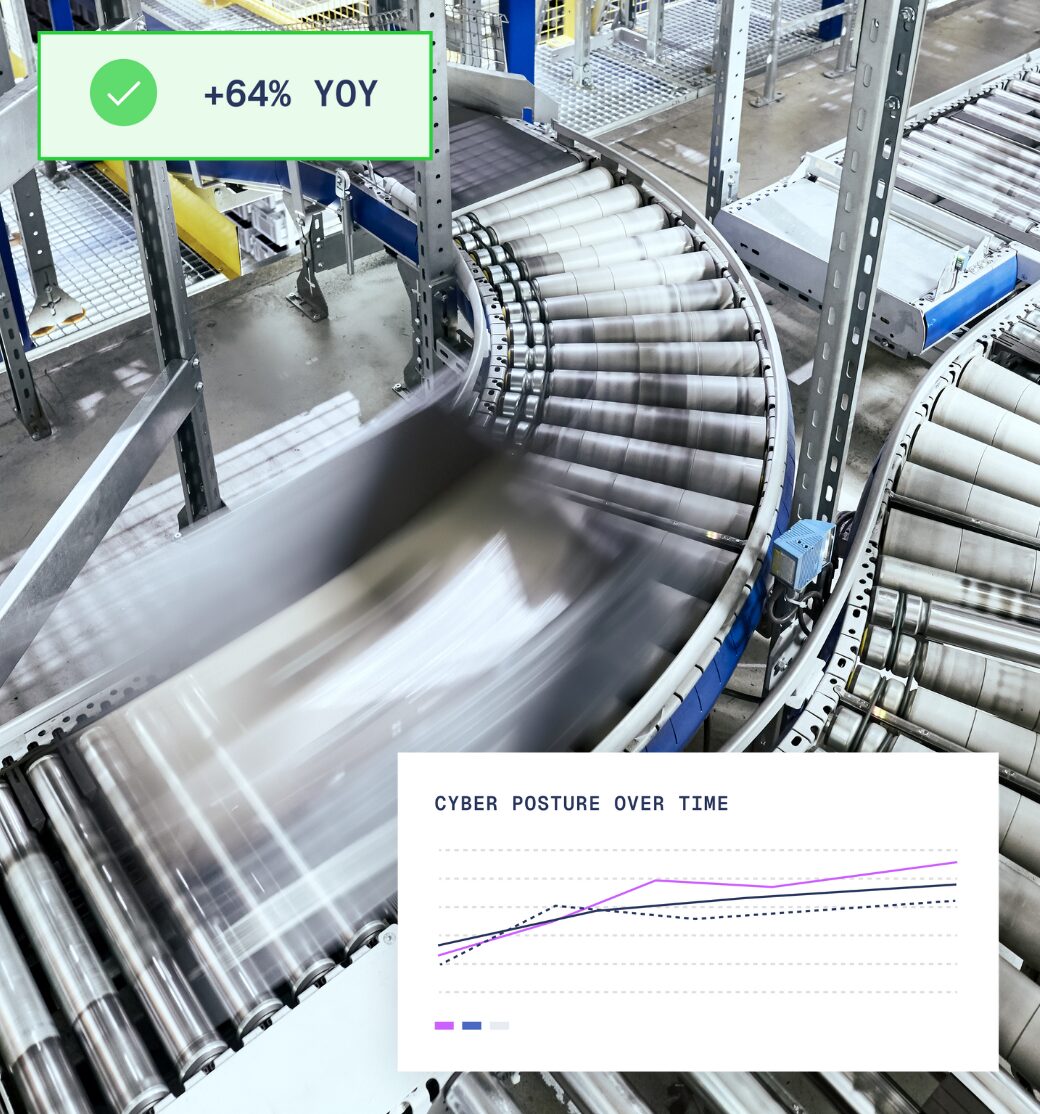

We assess your security infrastructure and determine security gaps

Utilising evidence and data from our automated risk, compliance, and security operations, your vCISO will create an action plan to address the critical vulnerabilities and compliance gaps your security team should focus on to reduce both premiums and risk.

We help and guide your teams throughout the implementation phase

We map your new and improved controls to underwriting requirements

We provide your broker with the evidence they need of your new and improved controls, including proof of continued posture hardening and compliance against key standards to help obtain the best commercial and coverage terms possible.

Access insurance-approved incident response (IR) and legal guidance in case of an incident.

Once your cyber insurance assessment is complete and your policy is in place, you will have the reassurance of access to world-class and insurance approved IR, forensic analysis, and restoration capabilities. Our vCISO will continue to stress test your new capabilities to ensure your teams are ready for the next cyber-incident.

Cyber insurance assessment FAQs

Cyber threats like hacking, ransomware, and phishing are on the rise, and even secure businesses can fall victim. A cyber incident can cause significant financial loss, legal challenges, and reputational damage. Cyber insurance provides a financial safety net, helping you recover quickly and maintain business continuity.

Like all insurance policies, it will depend on the individual policy and the level of coverage taken out but most cyber insurance will include:

- Data breach response including the costs of notifying customers, credit monitoring, and legal support.

- Ransomware and extortion payments and negotiation costs.

- Business interruption and compensation for lost income if systems go offline.

- Third-party liability and legal costs if customer or partner data is compromised.

- Forensic investigation and expert support to identify the source and scope of an attack.

- Reputation management – PR and crisis communication services.

A Vambrace cyber insurance assessment will make sure this is the case.

Premiums depend on factors such as business size, industry, data sensitivity, and existing security measures in place. Generally, the stronger your cybersecurity posture, the lower your premium.

No. Cyber insurance is part of a mature cyber posture, it does not replace strong security practices. Insurers often require evidence of safeguards and controls in place when it comes to firewalls, encryption, password management, and employee training before a policy is underwritten.